When you teach your kids to handle money, they learn not only responsible spending but a long-lasting impact that will make them responsible adults in the future.

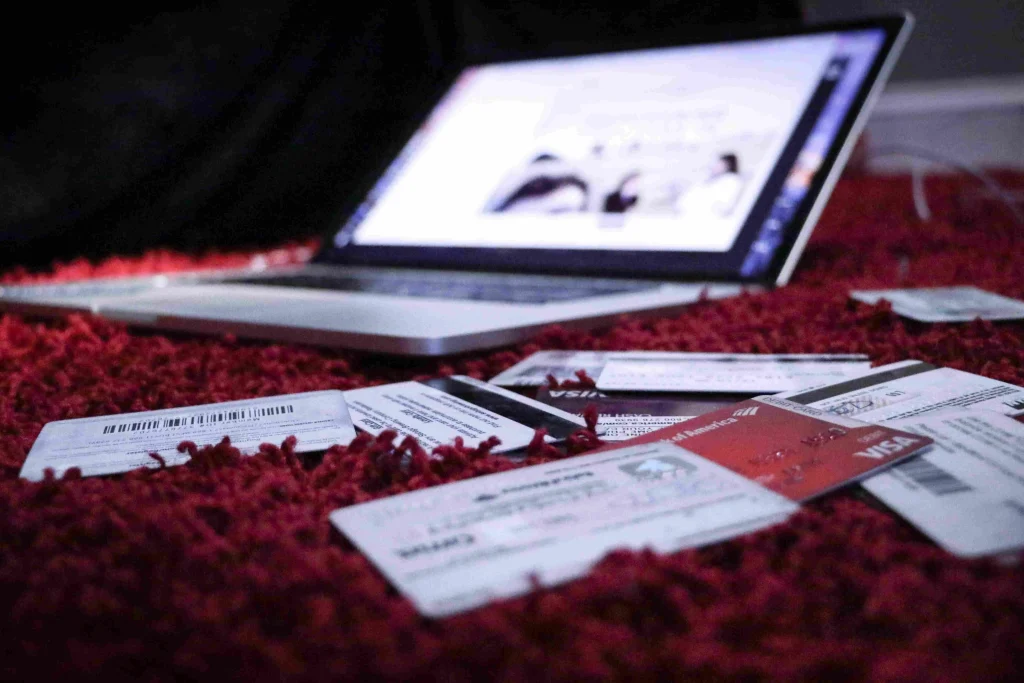

Besides a crucial lesson, explaining to your kids about credit, savings, and spending will make them understand that handling money is a big responsibility. Include them in the credit card user and teach them how it works for emergency purposes. Start with opening a bank account for your child to give them the responsibility to track their savings and encourage them to save.

Teaching Your Kid About Credit and the Advantages

So now you’ve done the basics of explaining to them the financial responsibility of money, it’s time to move on to explain to your child the world of credit scoring. Often credit cards are misunderstood and even adults are not able to utilize their credit scores because of this. Let your kids know the importance of a good credit score and the advantages this can do for them, especially on long-term goals and financial negotiations.

Try lending a small amount of money that they have to pay back as monthly payments. You can then offer rewards or incentives if they pay on time.

Why Should Kids Start Building Good Credit Scores?

Starting early will teach them the benefits of credit history. It will also teach them how debt or loan works so you shouldn’t be leaving this topic out of the discussion. Inform them about credit accounts and their long-term consequence if neglected or used irresponsibly.

It will make them understand the effects of bad credit score and be wary of how payment history affect their financial record. To start, here are some of the things you should talk about with your kids about credit scores and their advantages.

This would also give them an advantage when they are grown and when applying for loans. One of the things that banks look into when processing a loan is an individual’s credit score or credit history. So, by preparing your child’s credit score while it’s early, it would be easy for them to apply for a loan whether it is for a major project or when they are planning on buying a house and lot for sale.

How to Check My Credit Score Philippines

Credit Scores

Credit scores are three-digit numbers that contain information about your financial activities. Credit scores typically evaluate how you are able to pay off your loans. It also contains bank accounts you’ve opened from the first, inactive, to your active accounts.

A high credit score is important to get the benefits and approve loans from banks, credit applications, and money lending institutions. It is advised you maintain a good credit score to help lessen your woes or worries when paying off unnecessary expenses and dues.

Another thing about having a credit score is that you can get discounts with insurance rates, better deals, or in general, works with getting you the most out of your credit scores.

Credit Report

Insurance firms look through your credit history to see if you have any bad credit. If your credit reports show you have good credit, you’ll be able to pay less than those with bad credit scores. Besides a show of your credit score and background, credit reports also help you make objective decisions. This is useful for your loan processing and credit card applications.

Your credit report basically shows your past history, uses, credit score transactions, and the positives and negatives of your credit handling. Other financial institutions have access to these credit reports so if you’re applying for banks, loans, and again, insurance, be prepared with a good credit report. You can also get a copy of your credit report via CIC credit report. Just go to the CIC website and put in a request.

Credit History

A credit history differs from a credit report as this shows your newest and past payment history, the average age of your credit account, and the credit types used. You have to ensure that all loan repayments are paid. Regardless of cash loans, personal loans, or mortgages, this will show in your credit history if you’re a responsible payer or if you make payments on time.

A lender or a financial institution will also be checking your total debt amount or credit utilization ratio. So as early as now, build a good credit history as this will be included during background checks.

Benefits of a Good Credit Score

Financial institutions and telecom companies check your credit score when applying for a new bank account, bank loan, and credit card. So if you have a good credit score, these financial institutions will make it easy for you to avail of these financial services.

Lenders are those who approve of your loan applications or decide if you can borrow the money. So lenders assess first your history to see if your credit, income, and employed to manage repayments. And if you want to apply for a new loan account, car loan, or any loan, you can negotiate a lower interest given your good credentials. Those with lower credit or who have a negative credit report will often evade these loans because their request will likely be rejected.

Checking Your Credit Score

If you want to know your credit scores, you can simply request a CIC credit report. The credit score in the Philippines is between 300-850. Make sure not to apply for or open too many new accounts, have too many credit card loans, and make sure not to go over your credit limit. Don’t delay and have missed payments, maintain your credit score as this will provide great benefits.

Credit information

The Republic Act No. 9510 or Credit Information System Act (CISA) mandates, establishes, and centralizes reports and updates about your credit score or data. This is to avoid identity theft, fraud, and other issues concerning your credit information.

Credit Information Corporation (CIC)

The Credit information system act (CISA) gives authorization or power to CIC to handle and receive credit data. This provides access to credit reports and the financial condition of borrowers and credit users. This financial information is shared among financial institutions.

Credit score and real estate

Real estate is one of the things that your child should be investing in the future. To get started, explain to your child the benefits when purchasing real estate with a good credit score. Ideally, you should have a credit score of 620 or higher to be in real estate.

Cheaper mortgage

Mortgage insurance or private mortgage is insurance that will take care of your outstanding mortgage loan and protects your home from future disability in the event of an accident or death.

Lower interest rates

As mentioned, compared to those with low credit scores, you get better rates when applying for a personal loan. It will also avoid additional points included in those mortgage rates.

Home loan options

A lower credit score will only give you a limited loan, so if you have high credit, this will give you other options or multiple loan options.

Lower premiums

A high credit score gives you the “lowest down payment”. For a real estate loan, there are a few options for premiums.

- Single premium

- Monthly mortgage insurance

- Split premium mortgage

You can inquire at your financial institution about which premium would work best with your credit data. If you’re interested in viewing properties, check these house and lot for sale on Crownasia’s website. Real estate is a big investment and achievement, so don’t be afraid to start building your child’s

Bottomline

Besides education and health, invest in your child’s financial learning. While it might seem like a big topic to handle, slowly incorporate these tips into your child’s everyday life building them the future to handle their finances responsibly.

Related Blog: Teaching Your Children to Save Money for the Future