Investors frequently seek safety in assets that have historically demonstrated durability and steady growth during times of economic uncertainty and market turbulence. A prime example of such an asset class that offers a secure haven for the preservation and growth of wealth is real estate. A house and lot for sale is one of the most alluring real estate investment prospects.

As the world suffers from unfathomable issues, it is becoming more and more obvious that real estate, particularly a condo for sale, is a smart investment to have in your portfolio. Condominiums as a type of real estate investment have certain benefits that make them a desirable choice for investors looking for security and future growth. Condos offer a compelling possibility to weather economic uncertainty and attain long-term prosperity due to their physical form, consistent housing demand, and potential for rental income.

Real Estate Finance and Investments

Real estate finance and investments, which involve the administration and use of cash in real estate holdings for diverse purposes, are essential elements of the real estate sector. It includes a wide range of tasks, including managing investment portfolios and acquiring, financing, and developing real estate.

Real estate finance and investments, which involve the administration and distribution of cash for property-related operations, are key components of the real estate business. Real estate investments entail putting money into different real estate opportunities in order to make money, whereas real estate financing deals with getting funds for real estate transactions and improvements. For investors, developers, and business professionals looking to get involved in the exciting and possibly lucrative real estate market, both regions present a variety of opportunities.

Physical Asset Having Value in Itself

Real estate is a tangible asset with inherent worth, as opposed to stocks or bonds that reflect ownership in a corporation or a debt obligation. Regardless of changes in the market, the land and the things it contains will always have intrinsic value and function.

A physical object that has inherent value and utility is referred to as a tangible asset with intrinsic value, regardless of its market value or prevailing economic conditions. Tangible assets are assets that have a physical existence that can be touched, observed, and quantified in the context of investing. Real estate, machinery, equipment, precious metals, works of art, and other physical assets are examples of tangible assets.

Several Things Contribute to the Intrinsic Worth

- Scarce Supply: Land has a finite supply because it is a scarce resource. Land and real estate are in more demand as a result of rising urbanization and population growth, which raises their value.

- Real estate provides the necessary shelter and space for people to live, work, and engage in a variety of activities. Real estate has a stable and inherent worth due to the fundamental human need for home and workspace, which ensures a continuing demand for it.

- Rent or lease payments can be used by real estate to create money. As it guarantees the owner a consistent revenue stream, this constant cash flow adds to the property’s inherent value.

- Real estate assets can be used for a variety of things, including residential, commercial, industrial, or agricultural purposes. Being adaptable to shifting needs and market conditions increases its inherent value.

The idea of intrinsic value is crucial in investing because it gives tangible assets like real estate a sense of security and stability. The real estate maintains its underlying value and function despite economic downturns or market swings. Investors frequently look at physical assets with intrinsic value as a way to protect their money and as a buffer against market volatility.

Benefits for Diversification

Spreading assets over several asset classes, industries, geographies, and securities is a risk management method known as diversification. By reducing the impact of adverse occurrences on any one investment, diversification primarily aims to lower the overall risk of a portfolio.

With other financial assets like stocks and bonds, real estate frequently shows no association. This implies that real estate values and returns do not follow the performance of conventional assets in lockstep. Real estate often retains or even increases in value during periods when stocks are declining, acting as a hedge against losses. Compared to stocks, which can occasionally undergo quick and unforeseen price changes, real estate investments are often less vulnerable to short-term market volatility. A portfolio can be kept stable amid choppy market conditions by the smoother and more steady growth trajectory that real estate values often demonstrate.

When real estate investments are well-located and well-maintained, rental revenue from those properties can offer a consistent and predictable cash flow. This income stream can act as a buffer against portfolio losses in other areas and serve as a steady source of income. Long-term appreciation is possible for carefully chosen real estate assets in expanding markets. While there may be short-term swings, traditionally real estate investments have shown strong long-term appreciation, which has aided in the expansion of total portfolios.

Real estate is a desirable alternative for investors trying to create a strong and resilient portfolio due to the benefits of diversification. Investors can lower total risk, increase stability, and even increase long-term profits by including real estate in a portfolio of conventional financial assets. Diversification should, like any investment strategy, be based on thorough research, a risk assessment, and each investor’s own financial objectives to make sure it fits with their entire investment strategy.

Invest to Prevent Inflation

Money’s purchasing power is reduced by inflation, and many conventional investment assets find it difficult to keep up with growing inflation rates. However, because property values and rental revenue often increase along with inflation, real estate is regarded as a superb inflation hedge. Real estate values rise in tandem with rising living costs, protecting investors from the negative consequences of inflation.

Characteristics That Make Them Efficient Inflation Hedges

- Tenant rent is a common source of income for real estate assets. Rent costs might increase as a result of inflation. Rental rates can be frequently adjusted by landlords to reflect inflation, preserving the buying power of rental income.

- Real estate is a material asset with inherent value because of its usefulness and physical presence. Real estate properties maintain value despite inflationary pressures because they offer habitation, workspace, or commercial amenities, making them less vulnerable to inflation’s degrading impacts.

- When there is inflation, borrowing may become more expensive. Investors with fixed-rate mortgages, however, gain by paying an interest rate that is lower than the going rate in the market. The safety against growing borrowing costs offered by this fixed interest rate enhances cash flow and overall profits.

- Real estate investments can be used to diversify a portfolio and lessen the impact of inflation on other assets. Real estate can offer a more stable and inflation-resistant component in the portfolio while financial assets like bonds may see their real earnings reduced by inflation.

- The ideal strategy for investing in real estate is a long-term one. Real estate investments have typically outperformed the rate of inflation over lengthy periods, assisting investors in maintaining and increasing their purchasing power.

The real returns on many conventional investments can be adversely impacted by inflation, which can devalue money. Real estate provides a strong inflation hedge since it is a tangible asset with inherent worth. Real estate is a powerful tool for investors looking to safeguard their wealth and preserve their purchasing power in the face of inflationary pressures due to its potential for property value appreciation, rental income adjustments, intrinsic worth, limited supply, leverage advantages, and diversification advantages.

Forced Appreciation Through Improvements

Real estate investors will employ forced appreciation through improvements to raise a property’s value by performing specific improvements or repairs. Forced appreciation is a proactive strategy that provides investors more control over the property’s potential for gain as opposed to natural appreciation, which depends on market variables and general economic conditions to increase property value. When investing in real estate, where investors want to optimize profits and boost the profitability of their holdings, this method is particularly well-liked.

The Effectiveness of Coerced Appreciation Through Advancements

- Discover opportunities for value-adding: Before doing any renovations, investors must locate particular possibilities to add value to the property. This can entail remodeling the kitchen and bathrooms, putting in new flooring, upgrading the fixtures, enhancing the curb appeal, or changing the landscaping. Finding changes that are likely to raise the property’s market value and overall appeal is the aim.

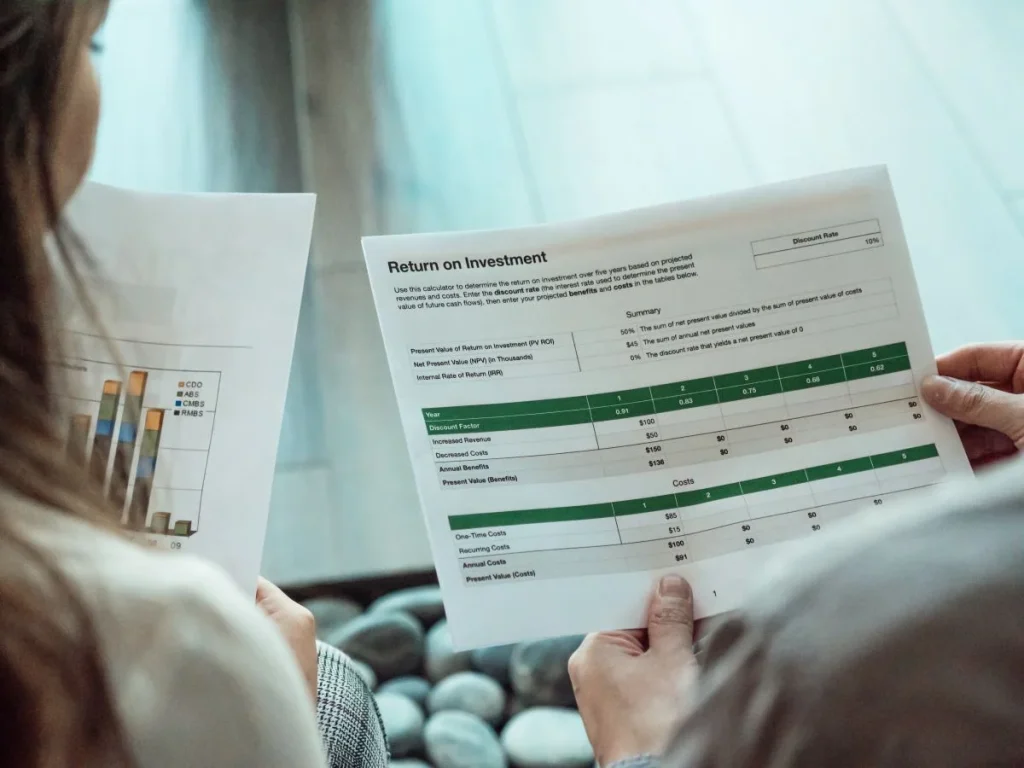

- Cost-Benefit Analysis: Investors should perform a cost-benefit analysis after identifying prospective improvements to ascertain the viability and potential return on investment (ROI) of each development.

- Implementing Improvements: During this phase, the real remodeling work is done. Investors have the option of managing the upgrades themselves or hiring professionals and contractors to do the work. Achieving the desired appreciation in value depends on employing high-quality materials and ensuring the quality of the craftsmanship.

- Market understanding is essential to selecting the types of modifications that will add the most value, as is knowledge of the local real estate market and the tastes of prospective tenants or buyers. The likelihood of experiencing a large rise is increased when the modifications are tailored to satisfy market demands.

- Observation and Assessment: During the renovation process, investors should keep a careful eye on the results and gauge how the changes will affect the property’s worth. This assessment aids in any necessary plan modifications and guarantees that the advancements are in line with the intended objectives.

Real estate investors can effectively boost the value of their properties by forcing appreciation through upgrades. Investors can increase the appeal and profitability of their real estate assets by spotting value-adding possibilities, performing rigorous cost-benefit evaluations, and carrying out planned upgrades. This strategy can produce larger profits and a more competitive position in the real estate market by giving investors more control over the future appreciation of their investments

.

Stability During Market Recessions

Historically, throughout market downturns and economic recessions, real estate investments have shown consistency and durability. Real estate has a number of attributes that make it more resilient to economic downturns than other investments, however, no investment is completely immune to market changes.

The desire for housing and business space is a fundamental human need that never changes, regardless of the state of the economy. The demand for real estate is sustained by the fact that people will always need a place to live and that businesses will always need places to function. Real estate is a material possession with intrinsic worth that offers a place to live, work, and do business. Due to its inherent worth, real estate will always be in demand and serve a fundamental need, regardless of economic ups and downs.

While no investment is completely risk-free, traditionally real estate investments have shown stability during market downturns and economic downturns. Real estate is resilient because of its inherent worth as well as characteristics including the ongoing need for homes and commercial space, the consistency of rental revenue, the scarcity of available properties, and long-term investment objectives.

Why Investing in Real Estate Is Helpful for a Portfolio? Why Is It an Effective Investment Decision?

Since real estate is a physical asset that offers a location to live, work, or conduct business, it has inherent value. Unlike stocks or bonds, real estate is something you can see, touch, and use, which gives it a sense of security and stability. Historically, the value of real estate has increased over time. Well-located homes in expanding markets frequently appreciate in value, giving investors a return on their investment. This expansion potential raises the overall return on investment.

Unlike typical financial assets like stocks and bonds, real estate behaves differently. Since real estate’s performance does not immediately correlate with that of other assets in your investing portfolio, it helps to diversify risk. The ideal way to approach real estate is as a long-term investment plan. Investors with patience who can keep onto their properties for a long time are more likely to reap the rewards of capital growth and reliable cash flow.

Due to its physical nature, reliable income stream, appreciation potential, diversification advantages, capacity to hedge inflation, tax advantages, low volatility, and long-term stability, real estate investment is a beneficial asset to a portfolio. Due to its distinctive qualities, it is a reliable investment choice that may help investors preserve and develop their capital over time.

Time and time again, it has been shown that adding real estate to a portfolio of investments is wise and reliable. For investors looking for stability and long-term growth, it is a desirable asset class due to its tangible form, benefits from diversification, consistent cash flow, potential for appreciation, and robustness during market downturns. Real estate can offer the stability and possibility for recovery needed to ensure your financial future as you navigate through unpredictable times. Consider including real estate in your investing strategy.

Related Blog: The Difference Between Passive and Active Real Estate Investing