Financial statements refer to written records of the financial activities, position and performance of a business, person, or other entity. It is a structured manner by which relevant information pertaining to the financial condition of an individual or a company is presented in a way that is easy to understand. They are also sometimes referred to financial reports. They should be relevant, reliable, comparable and easy to understand. Financial statements contain reported assets, liabilities, shareholders’ equity, income, expenses and anything related to an enterprise’s financial position. Simply put, financial statements allow one to see where the money came from, where the money went and where the money is now.

Financial statements aim to show the details pertaining to an organization’s financial position, its performance as well as changes in it. As these are made available, they allow someone who reviews them to arrive at pertinent economic decisions. They are often used by investors, market analysts, and creditors to evaluate a company’s financial condition and potential for growth. The four major financial statement reports are the balance sheet, income statement, cash flows statement, and statement of retained earnings.

Four Fundamental Types of Financial Statements

There are four major financial statement reports. They are the income statement, balance sheet, cash flow statement and statement of retained earnings.

Income Statement

This is the most important among financial statements. It conveys the company’s earnings as well as expenses over a period of time, which may either be a year or a financial quarter, and so on. It presents revenues, expenses, profits/losses, net income, as well as earnings per share. The main purpose of the income statement is to present details of profitability and the financial results of business-related endeavors. An income statement reflects multiple forms of revenues and expenses.

Hence, it may be used as a tool in determining whether the company’s revenue is increasing, particularly when compared across multiple reporting periods. Likewise, it indicates a company’s financial ability specifically on how well management is controlling expenses thereby increasing profits. Normally, this information is used by investors to gain insight on the performance of the company.

The multiple forms of revenues and expenses contained in the Income Statement are:

- Operating Revenue. It reflects the core business of a company. It is a result of how much money is earned from the sales of the company’s products or services.

- Non-operating Revenue. It is income or earning resulting from non-core business activities. It refers to income-generating activities that are not related to the nature of the business and may be a result of any or all of the following:

- Interest earned on cash in the bank

- Rental income from a property

- Income from strategic partnerships which may be royalty payment receipts

- Income from an advertisement display located on the company’s property

- Other Income. There is yet another source of income but is neither core nor non-core but these are those earned from other activities, such as gains from the sale of long-term assets including vehicles, land, or a subsidiary.

- Primary or Operating Expenses. This is the kind of expense a company incurs during the process of earning money from its primary activity. Such expenses include: Cost of goods sold or simply referred to as COGS, Selling, General and administrative expenses or SG&A, Depreciation or amortization and Research and development or R&D.

- Typical Expenses. These expenses are the type of expenses linked to secondary activities include interest paid on loans or debt. They include employee wages, sales commissions, and utility costs such as power and transportation as well as losses from the sale of an asset.

Balance Sheet

This is a financial statement summarizes a company’s assets, liabilities, and shareholders’ equity for a certain period of time. The date at the top of the balance sheet indicates the end of the reporting period. The items in a balance sheet are as follows:

ASSETS

They are anything and everything that the company owns that have value. Items listed under assets are:

- Liquid assets. These are assets that may be easily converted to cash in a short period of time. It includes cash and cash equivalents such as treasury bills and certificates of deposit.

- Accounts receivable. They are the amount of money owed by customers to the company for purchases on sales and services made on credit.

- Inventory. This refers to a complete list of items the company has in its possession. They may include finished goods in stock, goods that are still being processed that are not yet completed, raw materials on hand that will still be worked on or other contents of a building. They are intended to be sold as a course of business.

- Prepaid expenses. They are expenses that were paid for in advance but not yet incurred. In business, a prepaid expense is recorded as an asset on the balance sheet. They resulted from a transaction involving advance payments for goods or services to be received in the future. Although they are initially recorded as an asset, their value will be expensed over time onto the income statement. The business will receive something of value from the prepaid expenses over the course of several accounting periods and they provide continuous benefits over time. Examples of this type of expense are insurance and leased office equipment.

- Capital assets. These are assets owned by a company for its long-term benefit. They include property, manufacturing plants and heavy machinery or equipment used for processing raw materials.

- Investments. They are assets or items acquired with the the purpose of generating income or appreciation and is only being held for speculative future growth. They are not used in operations but are simply held for capital appreciation.

LIABILITIES

Theseare obligations of a company that results in the company’s future sacrifices of economic benefits to other entities or businesses. Items listed under liabilities are:

- Accounts payable. They are bills due as part of the company’s normal course of operations. They include utility bills, rent invoices, as well as obligations to buy raw materials.

- Wages payable. They are payments due to employees to compensate them for time worked.

- Notes payable. They are recorded debt instruments that pertains to official debt agreements, inclusive of their payment schedules and amounts.

- Dividends payable. They are unpaid dividends that are already declared to be awarded to shareholders.

- Long-term debt. It refers to a type of loan that matures in more than one year but it is considered as an asset for the holders of the debt. This can include diverse obligations, including sinking bond funds, mortgages, or other loans that are due in full in more than a year.

- Shareholders’ Equity. It is also referred to as stockholders’ equity. It represents the amount of money that would be returned to shareholders if all of the assets were liquidated and all of the company’s debt was paid off.

Cash Flow Statement

The cash flow statement is a financial report showing the movement of money during a period time. At times, it refers to as the statement of changes in financial position. It reveals where a company’s money is coming from and how money is being spent. This report provides a clear picture of the company’s stability. Detailed report on the following activities are shown in the cash flow statement:

- Operating Activities. They include include any sources and uses of cash from running the business and selling its products or services. Cash from operations includes any changes made in cash accounts receivable, depreciation, inventory, and accounts payable. These transactions also include wages, income tax payments, interest payments, rent, and cash receipts from the sale of a product or service.

- Investing Activities. This shows the use of cash coming from the investments of an enterprise. They include acquisition of a company’s asset like purchase of a property for sale or it may also be selling of an asset, loans made to vendors or received from customers, and any payments made in relation to a merger or acquisition.

- Financing Activities. This shows the movement of cash related to the use of funds to finance the company. This section provides the company’s investors to have the required knowledge regarding the stability of the company since these activities are reflective of the financial strength as well as the way the company manages its debt and equity distribution or its capital structure.

Statement of Retained Earnings

This is the type of financial statement that gives a detailed report showing the cumulative earnings of the business after any dividends or distributions are released to shareholders. Sometimes referred to as a statement of changes in equity, it also reveals the difference in retained earnings account between the opening and closing periods on each balance sheet.

Types of Financial Statements for Non-Profit Organizations

There is a difference between corporate institutions and non-profit organizations. Hence, it only follows that the financial statements used for each also varies. Non-profit organizations record their financial activities through these standard documents:

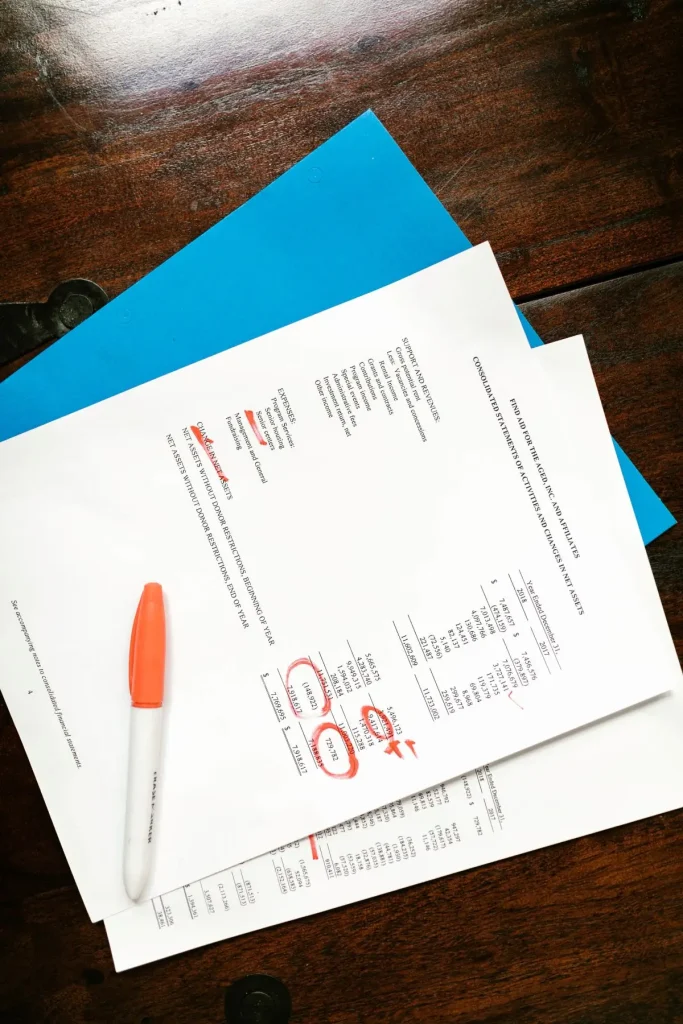

Statement of Activities

In a business enterprise, this is referred to as income statement while termed as statement of activities for non-profit organizations. It provides a detailed report of donations, grants, event revenues and expenses. Moreover, it records the changes in operation in a specific period of time.

This is the equivalent of a for-profit company’s income statement. It reports the changes in operation over time, including donations, grants, event revenue and expenses.

Statement of Financial Position

This is the equivalent of a corporate institution’s balance sheet. Since non-profit organizations do not have equity positions, it shows a big difference from the balance sheet. In the statement of financial position, net assets are residual balances after all assets have been liquidated and liabilities have been satisfied.

Conclusion

Financial statements are written records that convey the business activities and the financial performance of an entity with an effort to report them in a manner that will be easily understood. The income statement is considered to be the most significant among the types of financial statements and it focuses on a company’s revenues and expenses during a specified period. The balance sheet, on the other hand, conveys an overview of assets, liabilities, and shareholders’ equity. It is important to note that the cash flow statement or CFS reflects how well a company generates cash to pay its debt obligations, fund its operating expenses, and fund investments. Lastly, the statement of changes in equity records indicates how profits are retained within a company for future growth or distributed to external parties.